kansas sales tax exempt form agriculture

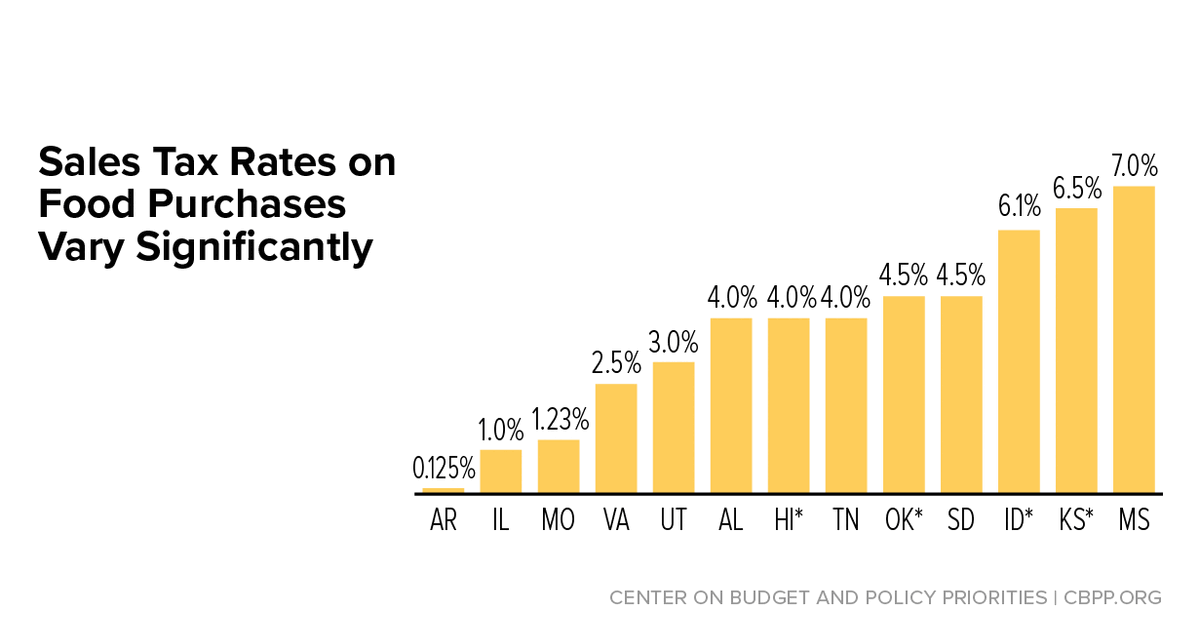

Ingredient or component part Consumed in production Propane for agricultural. Web While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Web Online Applications and Renewals.

. These are the tax. Compensating Use Tax from our website. Dealer licenses occasional sales cervid.

However there are four sales and use tax exemptions specifically for agribusiness. Feedlots and small animal forms can be submitted online through USAHERDS by clicking here. Web is exempt from Kansas sales and compensating use tax for the following reason check one box.

Including grain bins silos and corn cribs were exempted from sales tax. This page discusses various sales tax exemptions in. For corporations whose business income is solely within state boundaries the tax is 4 of net income.

Complete the Streamlined Sales Tax Agriculture Exemption Certificate before making your agricultural related purchases with KanEquip. Web Corporate Income Tax. Web How to use sales tax exemption certificates in Kansas.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for. The Kansas sales tax rate is a combination of the state. KDA HQ Emergency Evacuation Plan.

Web is exempt from Kansas sales and compensating use tax for the following reason check one box. In addition net income in excess of 50000 is. KS-1510 Kansas Sales Tax and.

Web For tax exemption status. Homeland Security TrainingIS 700. Web farmers per se are not exempt from Kansas sales or use tax.

Web KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services.

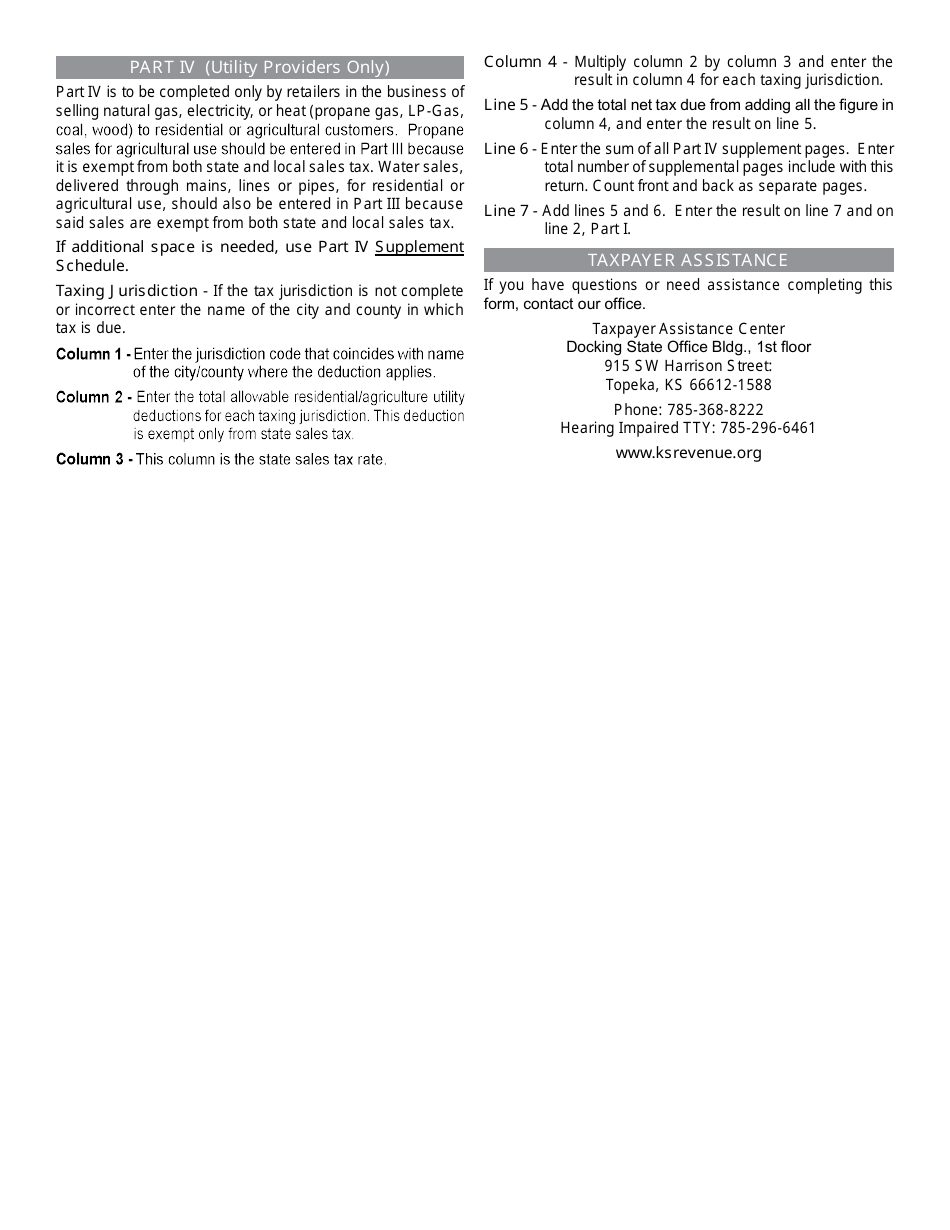

Form St 36 Download Fillable Pdf Or Fill Online Kansas Retailers Sales Tax Return Part Iv Utility Companies Supplement Kansas Templateroller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

St28a Form Fill Out Sign Online Dochub

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

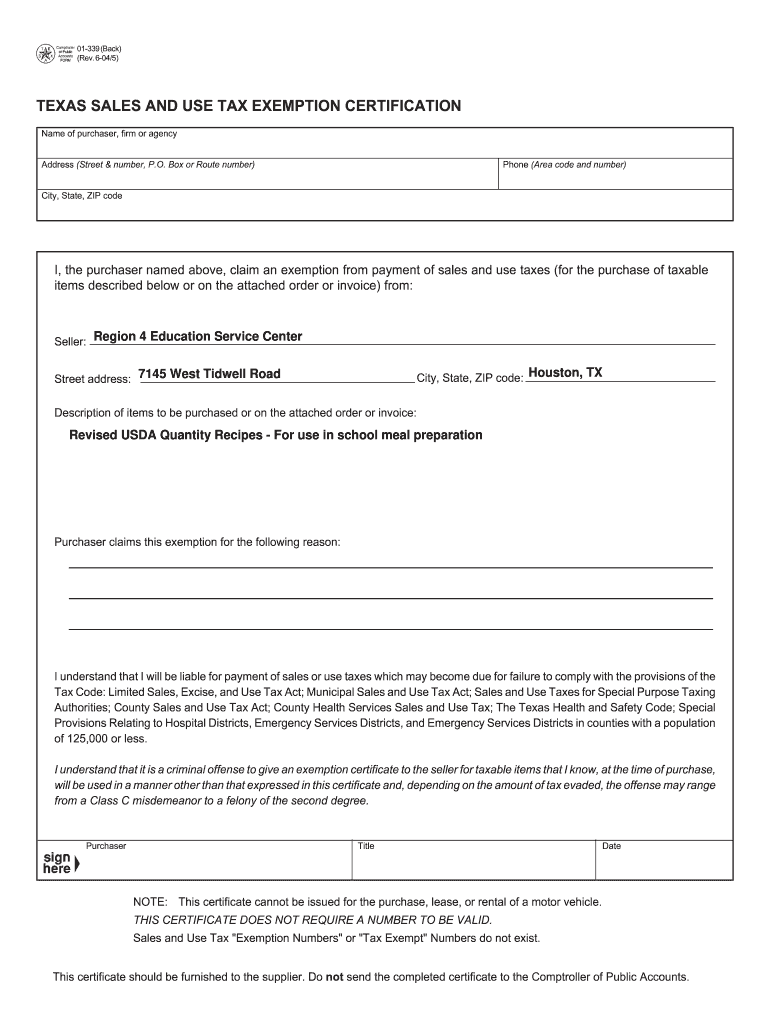

Usda Tax Exempt Form Fill Out Sign Online Dochub

Individual Income Tax Tables And Rates Kansas Department Of

Illinois Sales Tax Exemptions On Farm Equipment

Kansas Tax Exempt Certificate Fill Out Sign Online Dochub

Pro And Con Tax Provisions In The Build Back Better Act

Kansas Bill Targeting Property Tax Breaks For Wind Farms Fails In Committee Vote Kansas Reflector

How To Get A Certificate Of Exemption In Minnesota Startingyourbusiness Com

How To File And Pay Sales Tax In Kansas Taxvalet

Insects In Kansas 4 H And Youth Extension Entomology Kansas State University

Kansas Business Development Incentives

Your Guide To The United States Sales Tax Calculator Tax Relief Center